Shopping Bag

0

- No products in the cart.

Coffee will benefit as Asia asserts itself as a major hub of global trade, supplementing traditional producers and possibly surpassing them if weather patterns continue to lower yields―but low prices persist.

World coffee exports rose to an all-time high in 2016/17. Shipments were 122.45 million 60-kilo bags, a 4.8% increase compared to the previous harvest. Vietnam is now the world’s second-largest coffee exporter and China is the world’s ninth largest producer of arabica. China’s domestic market is projected to grow to $95 billion (¥600 billion) by 2020.

Output in Yunnan province, which produces 95% of China’s coffee, totaled 58,600 metric tons in 2017. The coffee exchange in Chongqing, in southwest China, reported $2 billion (¥13 billion) in trade since opening in June 2016 with $1.55 billion (¥9.7 billion) in trade in calendar 2017. Meanwhile, the new Yunnan Coffee Exchange is bringing specialty grades to market at prices significantly higher than commercial grades with exports to 30 countries valued at $393 million.

Peng De, general manager of the Chongqing Coffee Exchange intends to “change the existing industrial pattern” and gain pricing power by becoming the world’s third-largest coffee trading center (behind London and New York). In a report published by the Xinhua news service, Peng De said “advanced logistics and service, and the good quality and output of coffee produced in neighboring Yunnan Province will help the municipality realize its goal.”Global production was approximately 160 million 60-kilo bags last year, slightly ahead of consumption, according to José Sette, executive director of the International Coffee Organization (ICO). Asia and Oceania are experiencing the greatest compound annual growth at more than 2% per year. Emerging markets now consume 15% of the world’s coffee, up from 2% in 1965, he told attendees in January at the 1st Pu’er International Specialty Coffee Expo.

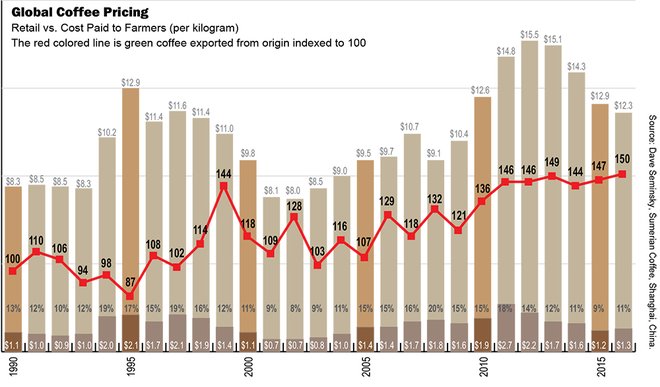

Boosting domestic consumption in producing nations such as China stabilizes demand and reduces market volatility, he said. It is difficult to pinpoint a price level that will discourage coffee production but low farmgate prices are a long-term concern compounded by climate change. “It is the mission of ICO to enhance farm profitability through more efficient supply chains, increasing the share of FOB price received by farmers,” he said.

Dave Seminsky, founder of Sumerian Coffee in Shanghai, China predicts “a stabilization in exports with a possible drop in production. For the prior three years, year-over-year, we’ve seen growth. However, I think soon climate change is going to begin to curb yield.”

“In 2050 we are looking at an increase of 2.5 times in global demand versus current global consumption. It is extremely likely climate change will reduce farm yields by 50% compared to today’s output,” he said. “If you take a look at the amount of speculative trading that is taking place in the C future contracts—upwards of 40% it’s just going to create volatility with not much stability.”

Only 3% of coffee traded on the futures market is actually physically delivered.

He points out that “if we push up the price of coffee hard enough we will squeeze the shorts (speculators) out of the market and the price will rocket.”

Open Markets

Open markets are what lifted billions of Chinese, Vietnamese, and Malaysians from poverty. The ASEAN trade block and the newly established 11-nation Trans-Pacific Partnership (sans the vocal and temperamental US) has every intention of easing trade barriers for nations growing a sizeable amount of the world’s coffee.

The fact that the trade pact was approved without the US is promising. The agreement was first envisioned as a tool to reduce trade friction between Asian countries and the US. The TPP signed in March 2018 will link markets that total 14% of the world’s GDP. In January, during the World Economic Forum global summit, Canadian Prime Minister Justin Trudeau said the new deal shows TPP members are pushing back against protectionism.

“If we are going to push back against the anti-trade tendency in globalization that will leave us all worse off, we have to put the concerns and the well-being of our ordinary citizens at the center of what we are negotiating, and that is what 11 of us have been able to do with TPP,” Trudeau said during a televised panel discussion.

One very eager new buyer is Dubai where the Multi Commodities Center (DMCC) is constructing a 7,500 m2 temperature-controlled storage and warehousing facility with a capacity of 20,000 metric tons annually and offices for coffee traders. Expected annual trade value is $100 million, according to DMCC. Coffee companies pay no duty landing in Dubai which intends to be a coffee center for value addition modeled on its work in tea.

DMCC accounted re-exported 53 million kilos of tea (60% of global share) last year, of which 6.33 million kilos was value-added. Exporters pay $250 (AED950) to load or unload 40-foot containers with free storage for up to 45 days and another 21 days of warehousing at no charge for value-added products. After 66 days, the warehouse fee is 40-cents per metric ton, per day.

Precarious balance

The global balance of demand and supply slightly favors production, observes ICO’s José Sette. Lower prices have not deterred farmers. A dramatic shift in acreage away from coffee has been offset by bigger gains in yield.

Outliers continue to spring up. A surprise bumper crop in Honduras last year overtook Ethiopia as the third-largest arabica producer behind Brazil and Colombia. In 2017/18 Honduras predicts a record 7.3 million bags and the US Department of Agriculture forecasts an even greater 7.4 million bags. These totals are even more impressive given the severity of damage caused by coffee leaf rust.

While coffee producers ably demonstrate their resilience, world consumption is climbing steadily toward a significant gap by 2030, according to Sette. The gap can only be closed through sustainable increases in farm productivity that includes research into improved coffee varieties; the dissemination of new varieties and modern farming techniques with public support for rehabilitation and replanting along with access to finance (including long-term loans).

Ultimately success depends on farm profitability, he said and that comes down to an increased share of the retail price received by farmers.

Free Shipping On All Orders $200+ |